PM Modi Highlights India’s Fintech Revolution at Global Fintech Fest 2024.

Mumbai:

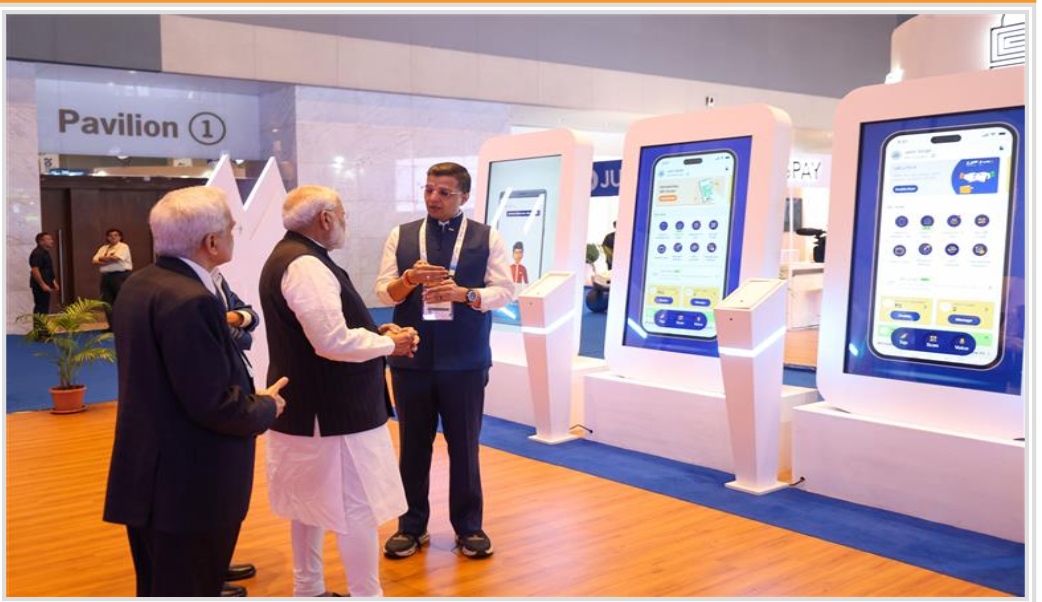

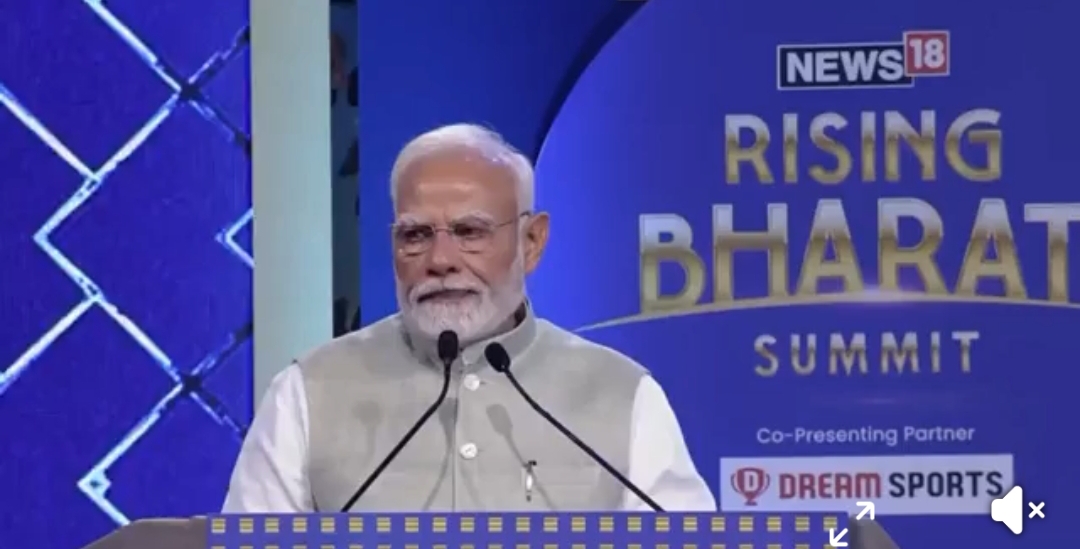

Prime Minister Narendra Modi today addressed the Global Fintech Fest (GFF) 2024 at the Jio World Convention Centre in Mumbai, showcasing India’s significant strides in the fintech sector. The event, organized by the Payments Council of India, the National Payments Corporation of India, and the Fintech Convergence Council, aimed to bring together key stakeholders and highlight India’s fintech advancements.

In his speech, Modi celebrated the current economic and market conditions, reflecting on the festive atmosphere and Mumbai’s role as a vibrant hub for fintech innovation. He praised India’s fintech sector, noting the impressive growth and investments over the past decade, including a record $31 billion in investments and a 500% increase in startup growth.

The Prime Minister underscored the impact of affordable mobile phones, inexpensive data, and Jan Dhan accounts, which have revolutionized financial inclusion. He highlighted the expansion of broadband users from 60 million to 940 million and the widespread adoption of Aadhaar digital identification. Modi emphasized that the Jan Dhan, Aadhaar, and Mobile (JAM) trinity has transformed the financial landscape, with India now leading globally in digital transactions.

Modi also pointed out the success of Jan Dhan Yojna, celebrating its role in women’s empowerment and its contribution to financial inclusion. He mentioned the Mudra Yojna, which has disbursed Rs 27 trillion in credit, with 70% of beneficiaries being women, and how Jan Dhan accounts are connecting rural women to the banking system.

Addressing the issue of parallel economies, Modi praised fintech for increasing transparency and preventing system leakages through Direct Benefit Transfer. He noted the fintech industry’s role in bridging the urban-rural divide and making banking services more accessible via mobile technology.

The Prime Minister highlighted the democratization of financial services through fintech, citing examples such as easy access to loans, credit cards, and investments. He also noted fintech’s role in facilitating digital transactions for street vendors and improving access to share markets and mutual funds.

Modi applauded the people of India for embracing fintech innovations and the Digital Public Infrastructure (DPI) for fostering trust in technology. He mentioned the advancements in Digital Twins technology, Open Network for Digital Commerce (ONDC), and the role of account aggregators and digital vouchers.

In closing, Modi urged the fintech sector to study the government’s Bank Sakhi program and highlighted the need for enhanced digital literacy and measures against cyber fraud. He emphasized the government’s commitment to supporting sustainable economic growth and advanced regulatory frameworks.

The event was attended by Reserve Bank of India Governor Shaktikanta Das and GFF Chairman Kris Gopalakrishnan, among others. The Prime Minister concluded with a selfie session and encouraged participants to access their photos through the NaMo app using AI technology.